Singapore businesses expected to increase investment in Vietnam

The two countries seek to boost cooperation in Singapore's strengths and Vietnam's potential, including the digital economy, knowledge-based economy, circular economy, renewable energy, sustainable industrial parks, and green finance.

The Hanoi Times — Singaporean businesses are looking to expand investment cooperation in the digital economy, circular economy, renewable energy, industrial parks, and green finance in Vietnam, attendees heard at a meeting between General Secretary of the Communist Party of Vietnam To Lam and representatives of leading Singaporean enterprises on March 11, as part of his visit to Singapore from March 11 to 13.

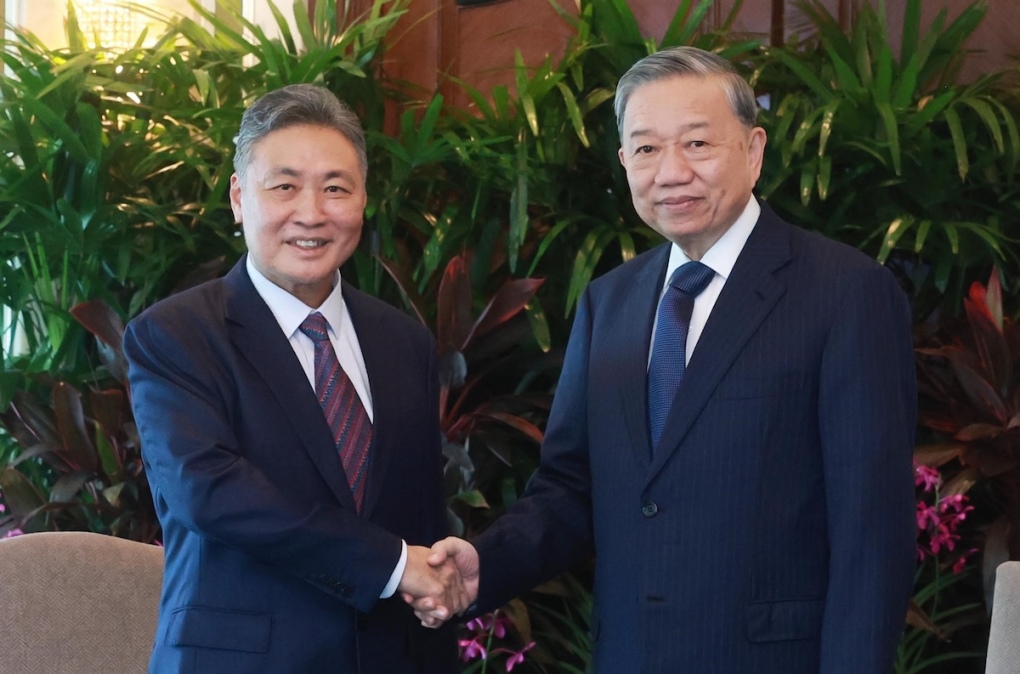

General Secretary To Lam (R) and Chairman of Temasek Holdings Lim Boon Heng. Photo: VNA

During a meeting with Lim Boon Heng, Chairman of Temasek Holdings, General Secretary To Lam said that Vietnam is targeting an economic growth rate of at least 8% this year to build momentum for double-digit growth in the coming years. To achieve this, Vietnam continues to attract large-scale foreign direct investment (FDI) projects for new growth drivers.

He said that Vietnam would support and provide a conducive environment for Temasek's investment and business activities in the country.

Temasek manages a portfolio of investments in energy, resources, telecommunications, financial services, real estate, transportation and infrastructure-related technology. Lim Boon Heng expressed the company's interest in investing in renewable and green energy in Vietnam.

By the end of last year, Vietnam's power system had nearly 17,000 MW of solar power (both rooftop and utility-scale) and over 5,000 MW of wind power, accounting for about 26% of total system capacity. Under the Power Development Plan VIII (PDP8), Vietnam is targeting 27,880 MW of wind power (onshore and offshore) and 12,836 MW of solar power by 2030.

The capacity of these sources could increase by 27,791 MW-34,667 MW, about 15% more than the current plan, as Vietnam considers adjusting PDP8.

Meanwhile, Sembcorp, another large Singaporean conglomerate, intends to invest in renewable energy and gas turbine projects in the near future. Sembcorp Chairman Tow Heng Tan called on the governments of both countries to cooperate on training programs and offshore wind power.

General Secretary To Lam said that the Vietnamese government is considering adjustments to PDP8 to promote the development of renewable energy. He welcomed foreign enterprises, including Sembcorp, to enter Vietnam's power sector, especially renewables.

Under PDP8, Vietnam seeks to achieve 6,000 MW of offshore wind power by 2030. In the draft adjustments to PDP8, the Ministry of Industry and Trade proposes to develop offshore wind power after 2030, targeting about 17,000 MW by 2035.

Chairman Tan also proposed pilot policies for the Vietnam-Singapore Industrial Park (VSIP). The general secretary acknowledged that VSIPs are a successful model of cooperation between Vietnam and Singapore.

Since the first VSIP was launched in the southern province of Binh Duong in 1996, Vietnam has become the country with the most Singapore industrial parks in the world, with 18 VSIPs in 10 provinces and cities. These parks have attracted more than US$18 billion in investment and about 900 projects, creating jobs for over 300,000 workers.

Executives from Keppel and CMIA Capital Partners also expressed interest in investing in industrial properties, infrastructure for industrial parks, and high-tech agricultural eco-urban areas in Vietnam.

Meanwhile, Lee Chong Min, Chairman of CMIA Capital Partners, urged Vietnam to expedite approval for the company to be the lead investor in a high-tech agricultural eco-urban project in Cu Chi District, Ho Chi Minh City. He also asked for consideration of preferential policies.

General Secretary To Lam said that relevant authorities will study the proposals and facilitate investment and business in Vietnam.

Party chief To Lam during a meeting with advisor at Shangri-La Healthcare Investment Tran Thi Lam.

During the meeting with the Party chief, Tran Thi Lam, advisor to Shangri-La Healthcare Investment and co-founder of Hoa Lam Shangri-La Healthcare, expressed the company's desire to continue effective investment in Vietnam, especially in high-tech medical zones. The company has been cooperating with Vietnamese partners in healthcare and medical services for nearly 20 years and will strengthen its business with Vietnam.

The general secretary reiterated that healthcare development is a top priority in Vietnam's socio-economic strategy. "Vietnam needs support from international investors, especially Singapore, which has extensive experience and expertise in this field," he said.

He encouraged Shangri-La Healthcare Investment to continue investing in healthcare technology and the production of high-quality medical equipment in Vietnam. He also urged the company to increase technology transfer to Vietnamese partners.

At a meeting with Lim Ming Yan, Chairman of the Singapore Business Federation (SBF), General Secretary To Lam said that the strategic partnership between Vietnam and Singapore continues to flourish in politics, diplomacy, economy, cultural exchanges, and people-to-people ties.

During the visit, both sides seek to boost cooperation in Singapore's strengths and Vietnam's potential, including the digital economy, knowledge-based economy, circular economy, renewable energy, sustainable industrial parks, and green finance. The general secretary said Vietnam will continue administrative reforms and support businesses investing and operating in the country.

Singapore was one of the first ASEAN countries to establish a strategic partnership with Vietnam (in September 2013), and remains one of Vietnam's largest trading partners.

Last year, bilateral trade between Vietnam and Singapore reached US$10.3 billion, a 14.7% increase from 2023. In terms of investment, Singapore is the largest ASEAN investor in Vietnam and ranks second among 147 countries and territories investing in the country, with 3,915 active projects and total registered capital exceeding $83 billion.